rhode island income tax withholding

The annualized wage threshold where the annual exemption amount is eliminated has increased from 227050 to 231500. Income tax withholding account including withholding for pensions or trusts Rhode Island Unemployment insurance account including Rhode Island temporary disability insurance TDI and Rhode Island job development fund tax Only the registration for the permit to make sales at retail including litter fee cigarette license gasoline license.

Ri 1120s Rhode Island Business Corporation Tax Return

UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI.

. The income tax withholding for the State of Rhode Island includes the following changes. Employers are not required to determine the correctness of the withholding allowance certificates and may rely on the number of state withholding exemptions claimed on the RI W-4 by the employee. Rhode Island Department of Revenue Director Guillermo L.

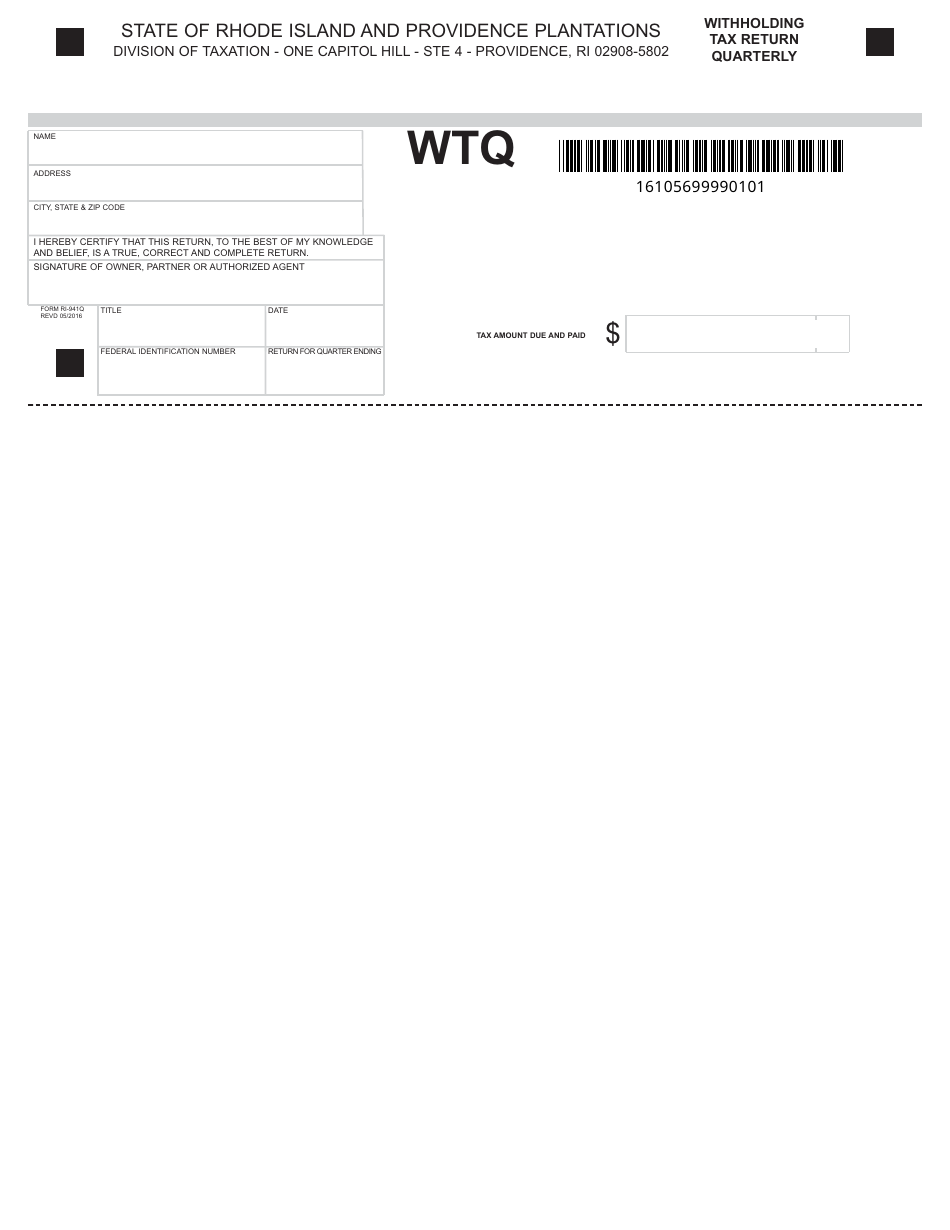

Individual tax forms are organized by tax type. Withholding Tax Filing Due Date Calendar 2021 2021 Withholding Tax Filing Due Date Calendar PDF file less than 1. Rhode Island Division of Taxation One Capitol Hill Providence RI 02908.

Estimated tax payments must be sent to the Rhode Island Department of Revenue on a quarterly basis. Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax. Complete Edit or Print Tax Forms Instantly.

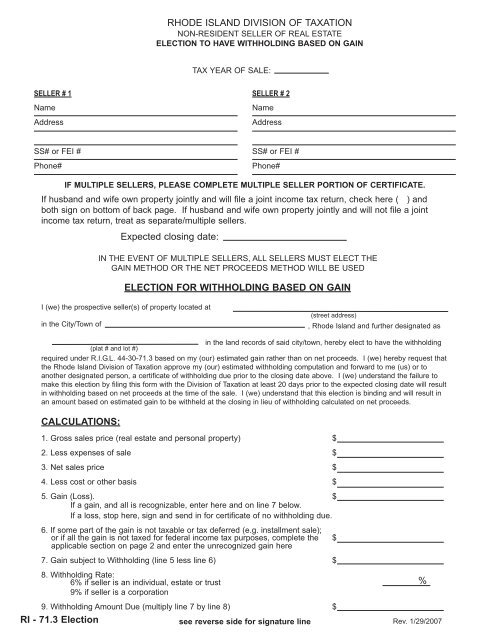

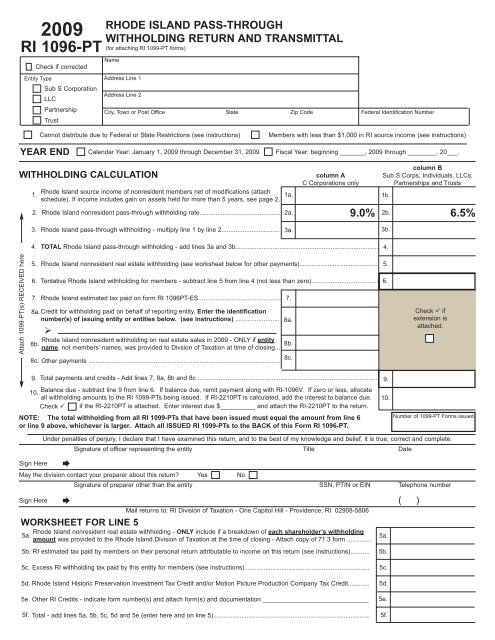

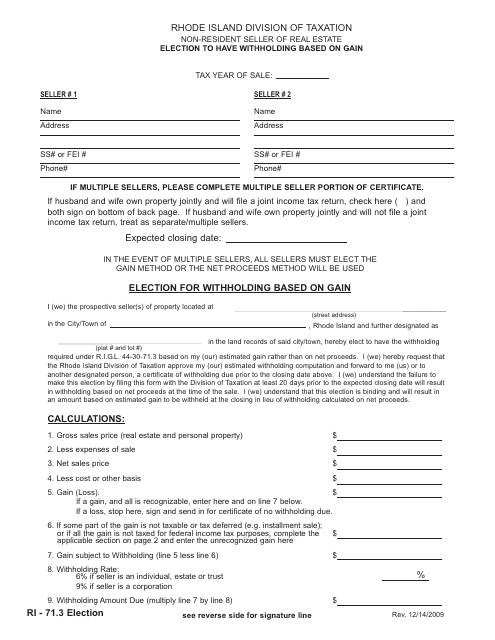

Forms Toggle child menu. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. Rhode Island has what is called a non-resident withholding tax in order to capture the income tax on the sale of a property.

The table below shows the income tax rates in Rhode Island for all filing statuses. Personal income tax withholding payments in year-to-date FY 2022 were 1060 million more than in year-to-date FY 2021 or 96. One Capitol Hill Providence RI 02908.

The additional amount of Rhode Island income tax withholding is entered on line 2 of Form RI W-4. Find your income exemptions. Employers withholding Rhode Island personal income tax from employees wages must electronically file andor pay the taxes withheld to the Division of Taxation on a periodic basis in the following situations.

Fiduciary Income Tax Forms. Select the tax type of the form you are looking for to be directed to that page. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table.

The Rhode Island state income tax is based on three tax brackets with lower income earners paying lower rates. Employees exempt from federal tax withholding. Subscribe for tax news.

If you have any questions or need additional information call 401 574-8829 option 4 or email TaxNonRes713taxrigov. EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELDA Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if. Residents and nonresidents including resident and nonresident estates and trusts are required to pay estimated taxes for each taxable year if the estimated tax can reasonably be expected to be 250 or more in excess of.

2021 Employers Income Tax Withholding Tables PDF file less than 1 mb megabytes. Access IRS Tax Forms. Nonresident Real Estate Withholding Forms.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Personal Income Tax Forms. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Laws 44-30-71c electronic payment of withholding tax is required for employers who are required to withhold and. Rhode Island Division of Taxation. The income tax wage table has changed.

Rhode Island Taxable Income Rate. No action on the part of the employee or the personnel office is necessary. If you are not a resident of Rhode Island or a corporation that isnt formed in Rhode Island the buyer of your property will have to file income tax on your behalf.

Guide to tax break on pension401kannuity income. The income tax wage table has been updated. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if.

1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services performed in Rhode Island. Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax. Laws 44-30-71c electronic payment of withholding tax is required for employers who are.

Find your gross income. 1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services. In ADV 2021-11 the Rhode Island Division of Taxation announced that it has extended through July 17 2021 previously extended through May 18 2021 emergency regulations that temporarily waive the requirement that employers withhold Rhode Island state income tax from the wages of employees temporarily working within the state solely due to COVID-19.

Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf. Hold Rhode Island income tax from the wages of an employee if. The annualized wage threshold where the annual exemption amount is eliminated has changed from 234750 to 241850.

To view tax forms for previous years please go to our Prior Year Personal. The annualized wage threshold where the annual exemption amount is eliminated. You should obtain your EIN as soon as possible and in any case before hiring your first employee.

The income tax withholding for the State of Rhode Island includes the following changes. To receive free tax news updates send an e-mail with SUBSCRIBE in subject line. 3 Even though the employees wages are NOT subject to federal income tax withholding the employer may withhold if the.

Find your pretax deductions including 401K flexible account contributions. Employers withholding Rhode Island personal income tax from employees wages must report and pay the taxes withheld to the Division of Taxation on a periodic basis depending upon the amount of withholding made from employees wages. 1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services performed in Rhode Island.

You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Up to 25 cash back Here are the basic rules on Rhode Island state income tax withholding for employees. FY 2022 total general revenue cash collections through April are up 140 or 5230 million from last fiscal year through April.

A the employees wages are subject to Federal income tax withholding and b any part of the wages were for services performed in Rhode Island 280-RICR-20-55-106C1. For more information on Nonresident Real Estate Withholding see Withholding Tax on the Sale of Real Property by Nonresidents 280-RICR-20-10-1. Lets say you sell an investment property in Rhode.

With rare exceptions if your small business has employees working in the United States youll need a federal employer identification number EIN. No action on the part of the employee or the personnel office is necessary.

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

Download Rhode Island Division Of Taxation

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

For Attaching Ri 1099 Pt Forms Rhode Island Division Of Taxation

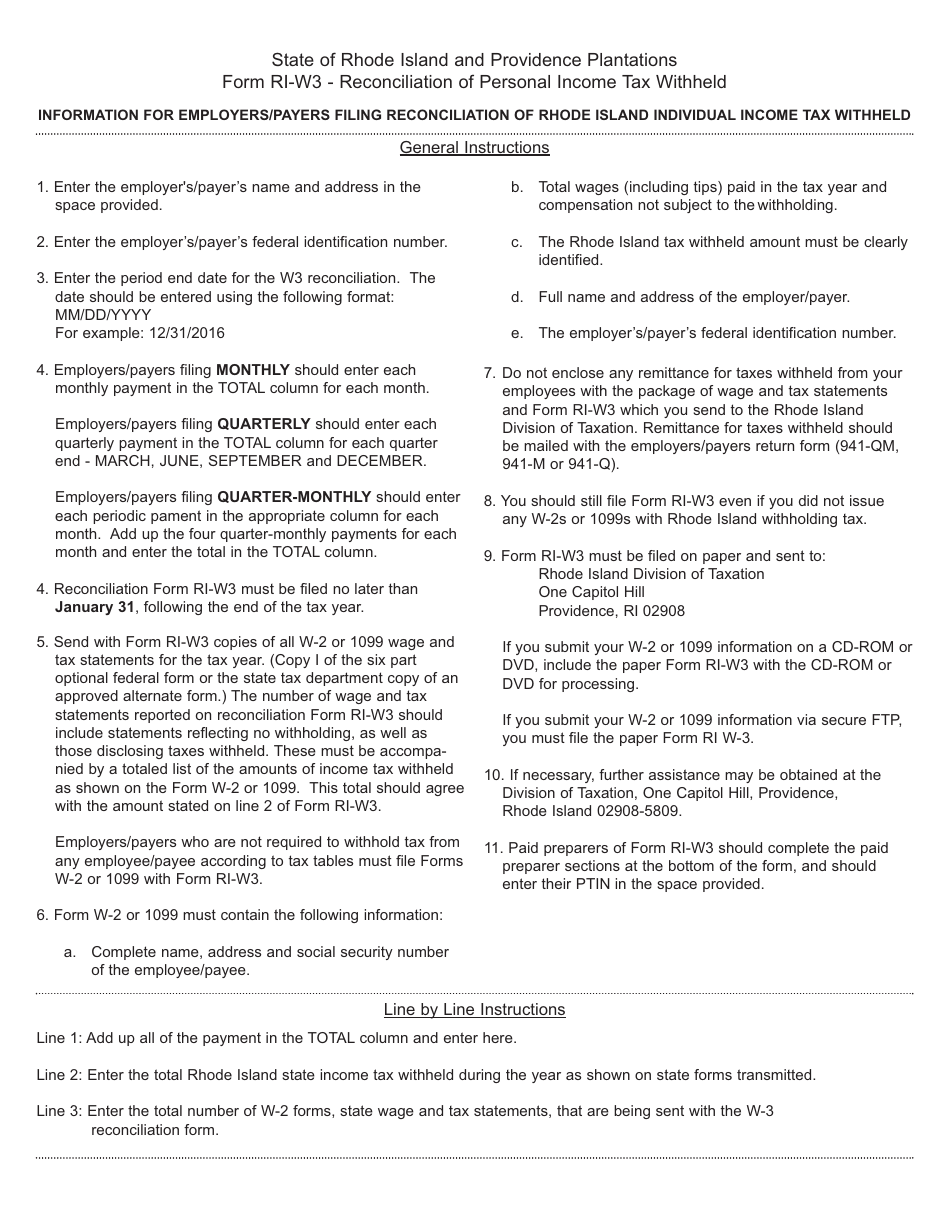

Download Instructions For Form Ri W3 Reconciliation Of Rhode Island Individual Income Tax Withheld Pdf Templateroller

Solved I M Being Asked For Prior Year Rhode Island Tax

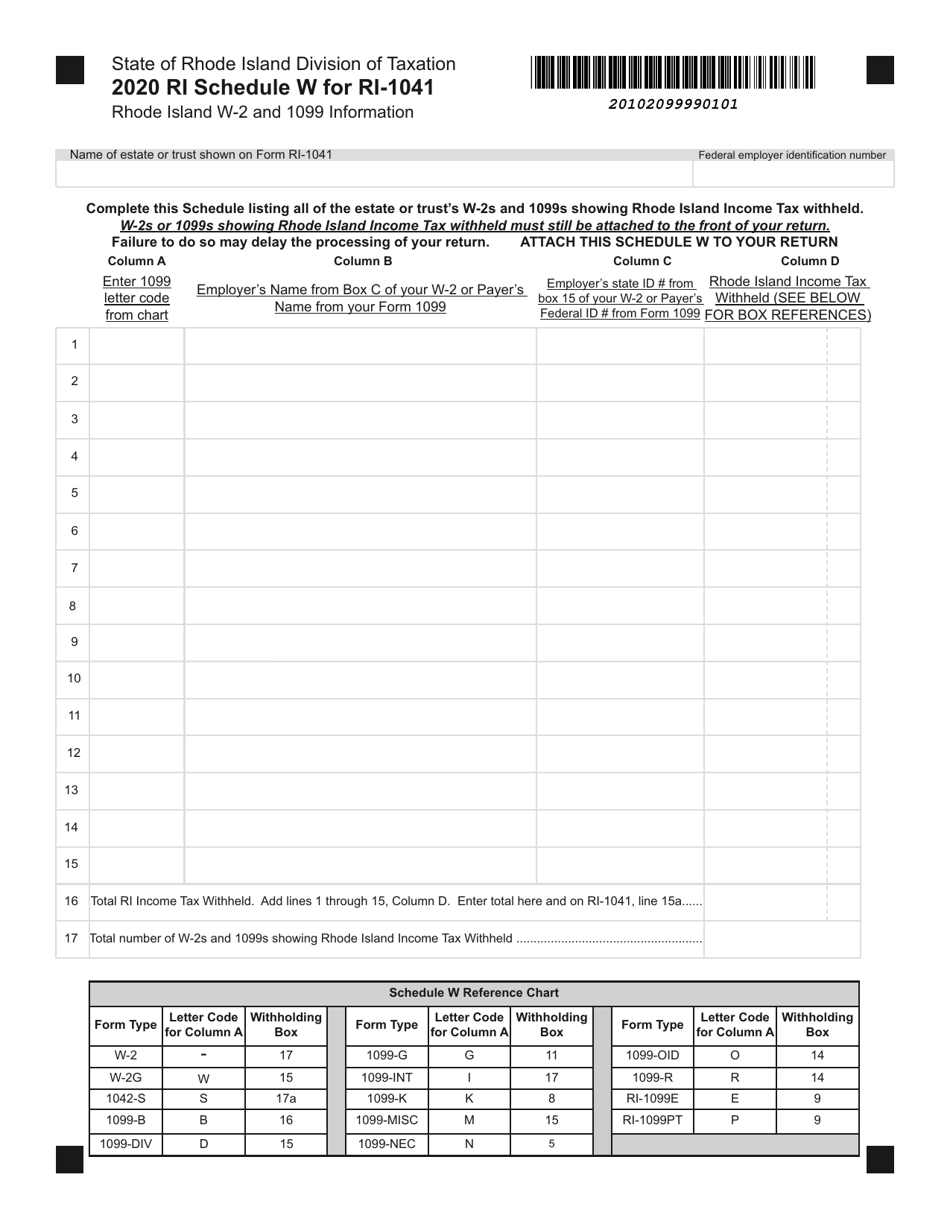

Form Ri 1041 Schedule W Download Fillable Pdf Or Fill Online Rhode Island W 2 And 1099 Information 2020 Rhode Island Templateroller

Rhode Island State Form W 4 Download

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Ri Ri W 4 2020 2022 Fill Out Tax Template Online Us Legal Forms

Prepare And Efile Your 2021 2022 Rhode Island Tax Return

Ri W4 Fill Online Printable Fillable Blank Pdffiller

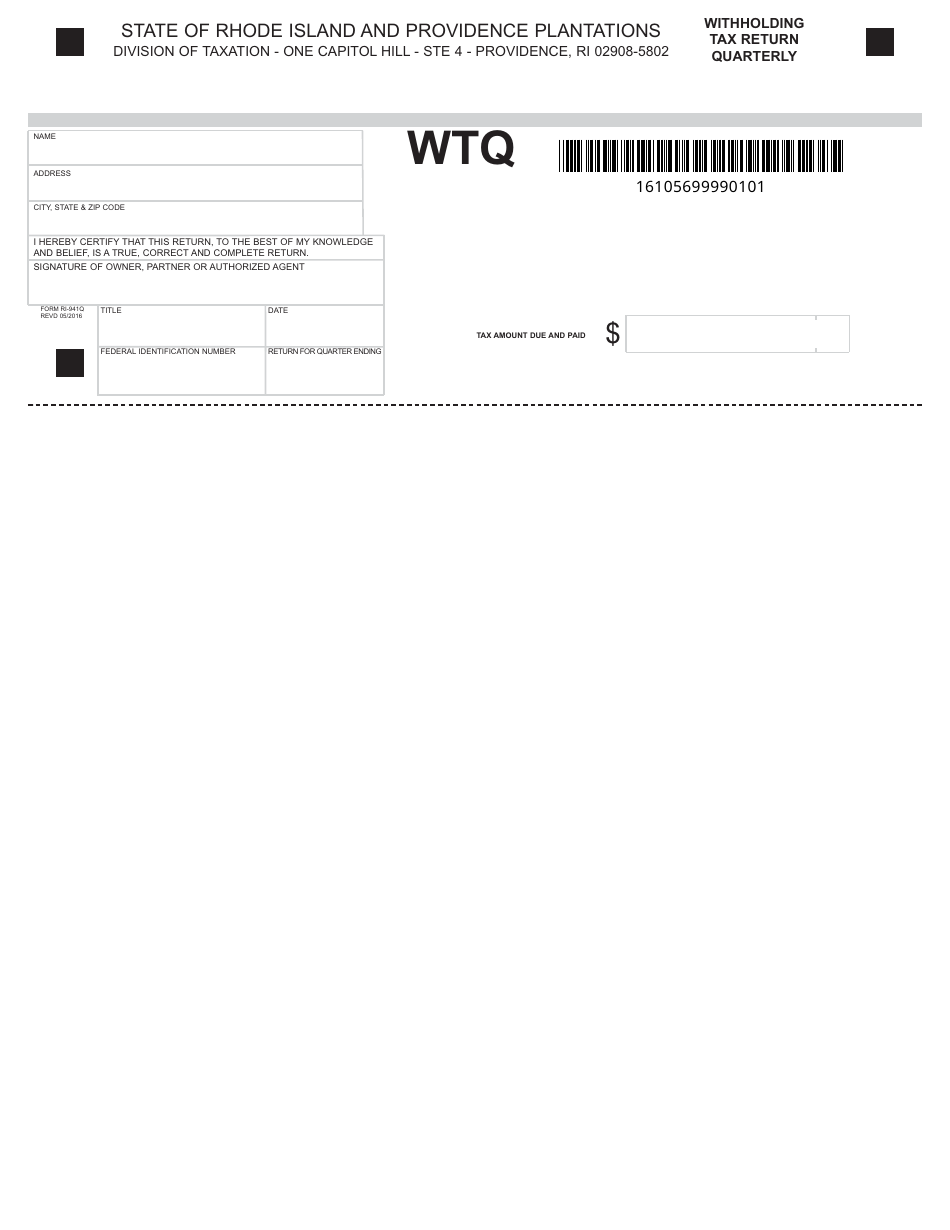

Form Wtq Download Fillable Pdf Or Fill Online Withholding Tax Return Quarterly Rhode Island Templateroller

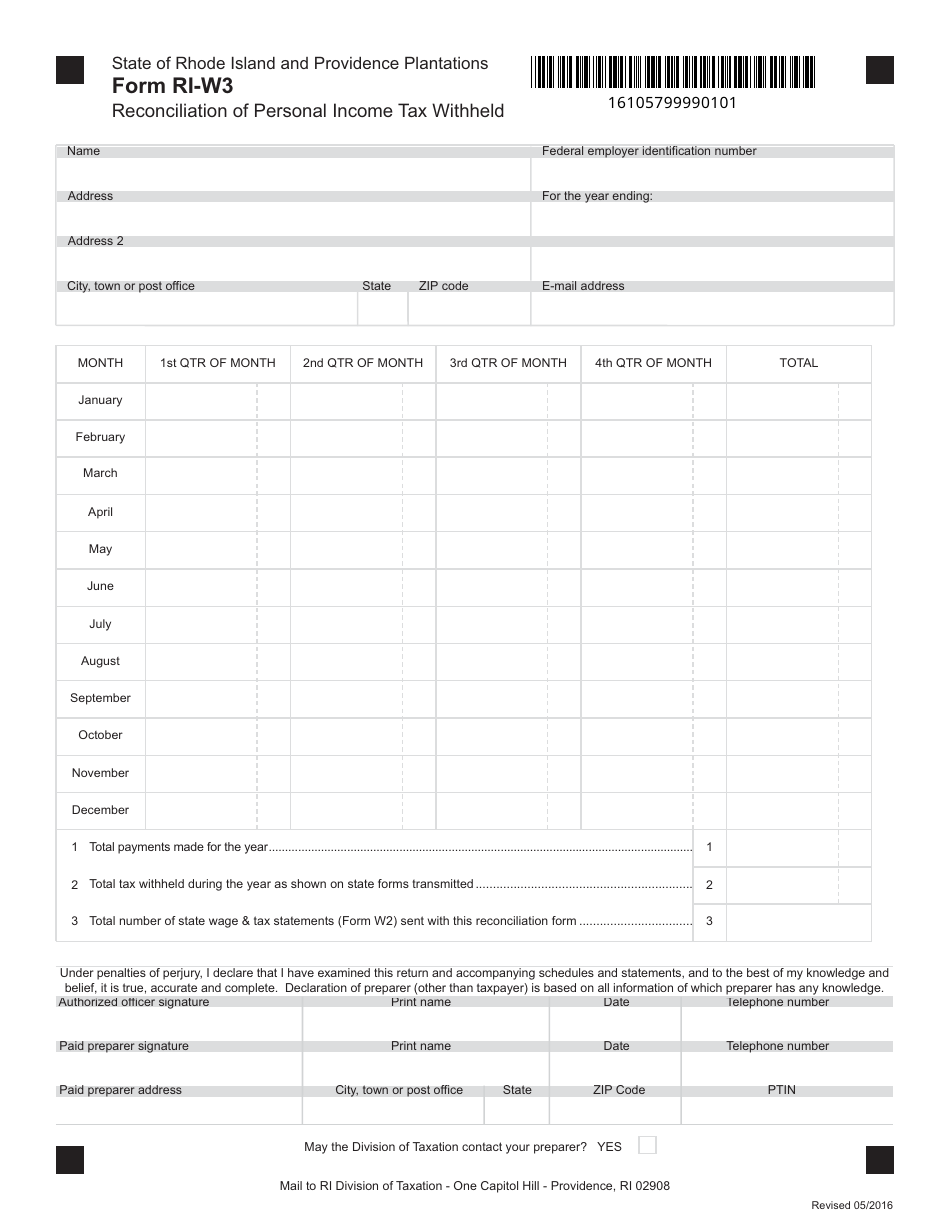

Form Ri W3 Download Fillable Pdf Or Fill Online Reconciliation Of Personal Income Tax Withheld Rhode Island Templateroller

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Form 71 3 Download Printable Pdf Or Fill Online Non Resident Seller Of Real Estate Election To Have Withholding Based On Gain Rhode Island Templateroller